The destiny of plant-based cheese substitutes

Image: Nielsen

Companies who have invested in plant-based cheeses in the belief that they could create big brands will be disappointed. Plant-based cheeses are a niche and set to stay that way. If your strategy is to create a niche, profitable business, that is a perfectly valid strategy as the “true believer” consumer niche is willing to pay price premiums of up to 100% over dairy cheese.

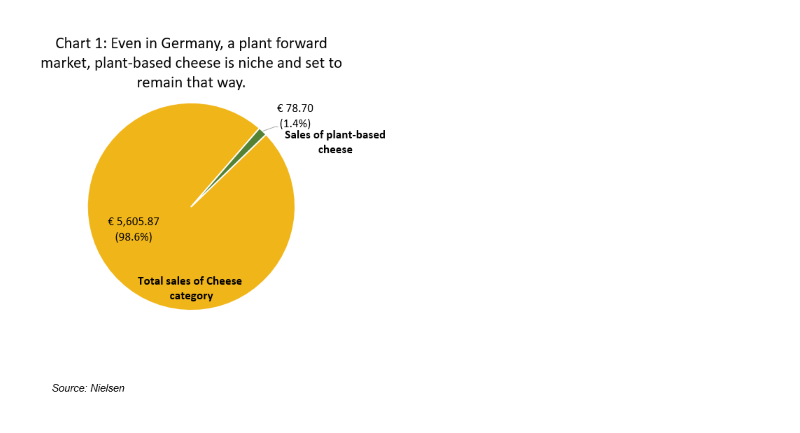

Even in the US market, plant-based cheeses have a just 1% market share. Supermarket sales data shows that sales in the US have fallen by 6% so far in 2023, in both volume and value, following a 3% drop in 2022. As the charts illustrate, plant-based cheese in Europe also remains small, despite several years of strong marketing and positivity about plant-based from mainstream and social media.

The trade press and advocates for these products often cite the high growth rates as evidence of future growth potential, but these growth rates are high percentages of small numbers. Ten percent annual growth of a market valued at €78 million is still only sales growth of €7.8 million. And the high percentage growth rates of recent years will fall as the ceiling is reached of motivated consumers.

A non-existent problem

Plant-based cheese is a solution in search of a problem. Consumers who are accustomed to eating dairy cheese will be just as deterred by plant-based cheese as meat consumers have been deterred by plant-based meat, and for much the same reasons.

The first challenge is the absence of any health benefit. Plant milks offer a digestive benefit for those consumers looking to avoid the digestive discomfort they get from dairy milks. But this is not a competitive advantage for plant-based cheese. Dairy cheese is already lower in lactose and for most people does not cause digestive discomfort. Plant cheese will not equal the market share achieved by plant milks.

The next challenge is taste. Plant-based cheese is up against a category – dairy cheese – that is about taste, texture and pleasure and plant-based fails on these points, other than for a very few customers.

Plant-based cheeses are in fact quite unlike their dairy based namesakes, with long ingredient lists. The chart illustrates the shortcomings of the sector. Dairy cheese has a short and simple ingredient declaration (what consumers have been telling us they want for the last 20 years). The other is engineered from multiple ingredients, and delivers no protein.

They are so different that they might as well be a totally new type of food, and one not called cheese. Consumers have been telling the food industry for two decades that they want foods with shorter ingredient lists and more “everyday” ingredients. In many categories in the supermarket, brands have quietly reformulated to meet that need. And yet some parts of our industry think that success can come from ignoring that 20-year consumer trend.

Vegan junk food

Plant-based cheeses are also deficient in nutrition. So deficient are they that one product developer who has created such products described them, “junk food for vegans.” And while it’s true that protein may not be “top of mind” for most consumers, it is what helps make cheese what it is.

If you want to actually deliver some protein in a plant-based cheese, the big problem is that, in terms of the amino-acid profile (the building blocks of protein), plant proteins are inferior in many respects to animal proteins. Because plant proteins have incomplete or imbalanced amino-acid profiles, product developers will have to use combinations of protein blends where amino-acid profiles of some proteins make up for the shortfall in others. All this adds to cost and product complexity.

Companies that, despite the increasingly obvious challenges, want to compete in cheese substitutes and create more than a niche product will have to invest heavily in creating a product that delivers on:

- Taste and texture

- Protein quantity

- Protein quality

- Nutrient profile/density

- Ingredient lists

None of that will be easy. Such a product does not exist and creating it will take years of effort. But without a dramatic technical improvement that results in a better experience for the consumer, and a taste experience that justifies the often 100% price premiums of plant-based cheeses, this sector will remain niche for the next five years. No corporate strategy in this sector should be based on strong growth.

It might even be wiser for companies to consider skipping plant-based cheeses entirely and look into the feasibility of using proteins produced by precision fermentation.

Over the last 20 years the advance of nutrition research has increasingly revealed the intrinsic nutritional advantages of dairy. Dairy fat has been exonerated of the negatives that were attached to it 40 years ago. The dairy food matrix in fact has many health advantages.

Dairy is one of nature’s whole foods, which aligns it with growing consumer preferences. It also is increasingly aligned with the direction of travel of science, which is attaching more negative outcomes to consumption of ultra-processed foods. It seems strange that anyone in our industry would not choose to focus on dairy’s natural advantages and instead busy themselves with creating an ultra-processed, “junk food for vegans.